Auto Insurance in and around Billings

Looking for great auto insurance in Billings?

Let's hit the road, wisely

Would you like to create a personalized auto quote?

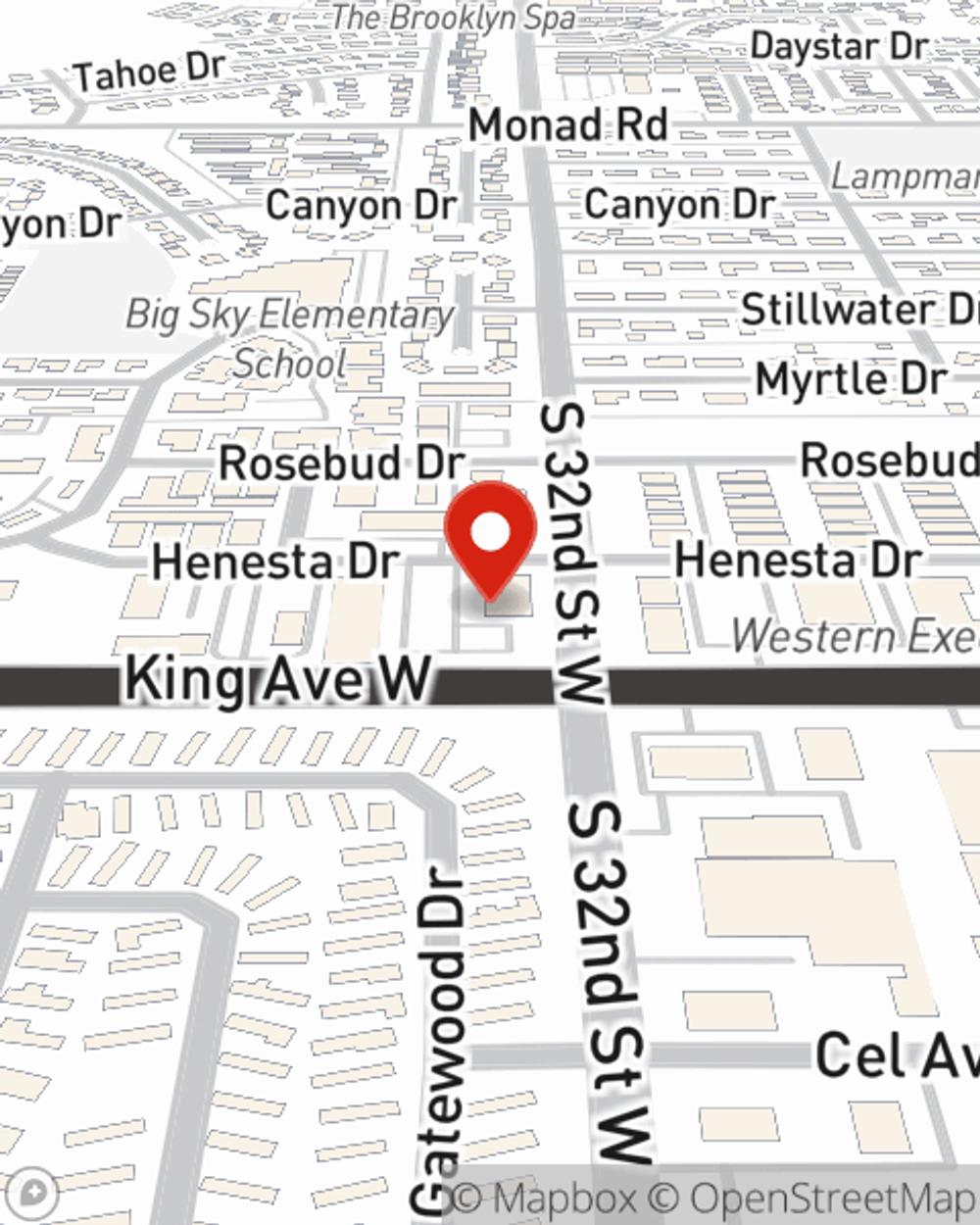

- Billings

- Laurel, MT

- Park City, MT

- Columbus, MT

- Red Lodge, MT

- Lockwood

- Yellowstone County

- Cody, Wyoming

- Lovell, Wyoming

- Powell, Wyoming

- Sheridan, Wyoming

- Broadview

- Roundup

Be Ready For The Road Ahead

Driving is likely an important factor of your daily routine. Whether you drive a hybrid or a SUV, you count on that vehicle to take you where you need to go, which is why excellent coverage for when the unpredictable occurs can be so vital.

Looking for great auto insurance in Billings?

Let's hit the road, wisely

Agent Diana Larson, At Your Service

But there are lots of ways to get where you are going and move from Point A to Point B. State Farm also offers insurance for van campers, kayaks, mini-bikes, dune buggies and golf carts. Whatever you drive, State Farm has you covered and stands ready to help with great savings options and attentive service. Plus, your coverage can be aligned to your lifestyle, to include things like car rental insurance and Emergency Roadside Service (ERS) coverage.

Auto coverage like this is what sets State Farm apart from the rest. State Farm is there whenever trouble finds you on the road to handle your claim promptly and reliably. State Farm has coverage options to get you wherever you are going from day to day.

Have More Questions About Auto Insurance?

Call Diana at (406) 656-4764 or visit our FAQ page.

Simple Insights®

Run-flat tires pros and cons

Run-flat tires pros and cons

Learn more about run-flat tires, their durability and the pros and cons.

Moped, scooter, e-bike & motorcycle differences

Moped, scooter, e-bike & motorcycle differences

Find out the differences between a moped, scooter and e-bike and whether a license and insurance is needed.

Diana Larson

State Farm® Insurance AgentSimple Insights®

Run-flat tires pros and cons

Run-flat tires pros and cons

Learn more about run-flat tires, their durability and the pros and cons.

Moped, scooter, e-bike & motorcycle differences

Moped, scooter, e-bike & motorcycle differences

Find out the differences between a moped, scooter and e-bike and whether a license and insurance is needed.